The Blue from American Express offers candidates with a slenderer credit profile an uncommon chance to gather important Membership Rewards focuses. Contrasted with other no-yearly charge American Express rewards cards, the Blue from American Express card doesn’t have a ton to bring to the table cardholders with incredible credit. It doesn’t promote a welcome reward, nor does it offer a major focuses program or a 0% APR.

The Blue from American Express merits your consideration, particularly in case you’re a continuous explorer. For instance, this often neglected section-level prizes card offers cardholders with great to average credit the uncommon chance to gather adaptable focuses with each buy. Surprisingly better: American Express flaunts perhaps the most liberal in and carrier move programs around, allowing you the opportunity to crush altogether more worth from your prizes card than you’ll ordinarily get from a passage level card.

American Express Eligible Cards:

- Gold Card

- Blue Cash Everyday

- Blue Delta Sky Miles

- The Platinum Card

- Cash Magnet Card

Features of American Express Blue Cash Everyday:

- Probably the greatest downside of this card is its absence of a welcome offer.

- While there isn’t a huge load of no yearly charge cards with liberal sign-up rewards

- There are a couple of American Express master cards with no yearly expense that do offer a welcome reward.

- Assume the Amex every day Praise Card from American Express, which accompanies 10,000 Membership Rewards points when you spend essentially $1,000 inside the initial three months.

- Every dollar you spend on the Amex Blue will acquire you a point.

- At the point when you make qualified travel buys through AmexTravel.com, like prepaid lodgings, prepaid vehicle rentals, flights, flight and inn bundles, and voyage reservations, you will get twofold the focuses.

- With no pivoting classifications or spending covers to stress over, you essentially utilize the card as frequently as you can and your points equilibrium will develop.

Rates of American Express Blue Cash Everyday:

- Annual Fee is $0

- No Purchase Intro APR:

- Regular APR is 23.99% Variable.

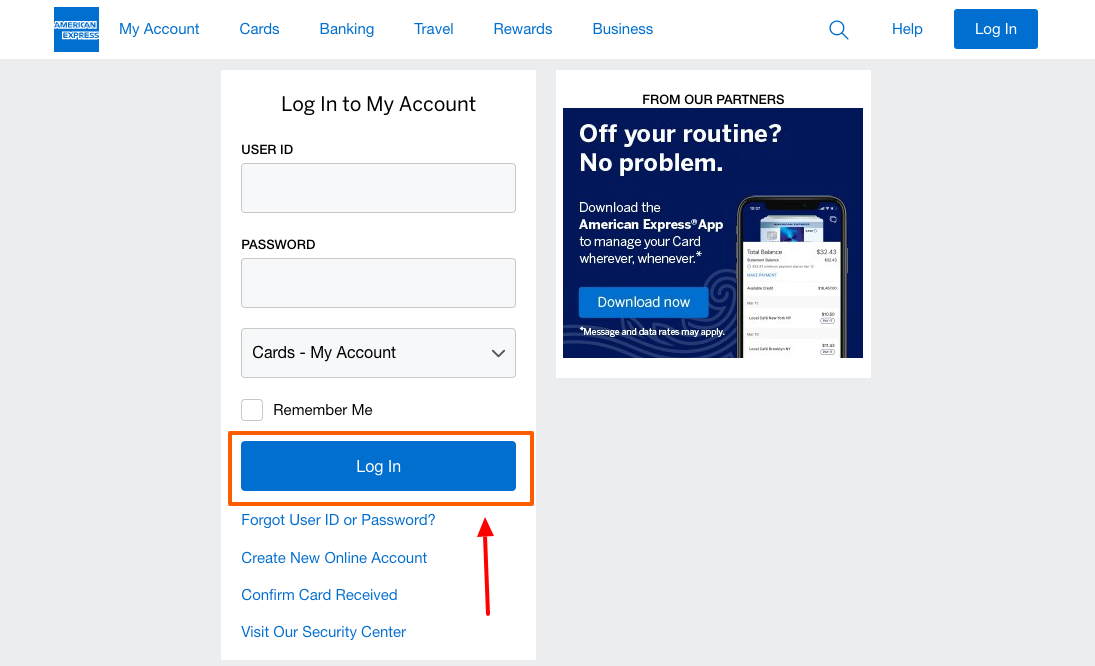

Login to your American Express Account:

- Open a new tab in the browser and enter URL www.americanexpress.com/account/login in the address bar.

- Click on ‘Log in’ button from top right side of the page.

- Enter your user ID, password click on ‘Log in’ button.

- This is the way to pay the card bill online after logging in to the account.

Reset American Express Login Initials:

- If you lost the login details use the link www.americanexpress.com/account/login

- In the login page click on ‘Forgot user ID or password’ button under the login boxes.

- Add the card number, card ID. Now click on ‘Continue’ button.

Create American Express Account:

- Go to the American Express login page by using the URL www.americanexpress.com/account/login

- In the login page hit on ‘Create new online account’ button below the login boxes.

- Add the card number, card ID click on ‘Confirm’ button.

Activate American Express Blue Cash Everyday:

- For the card activation use the URL www.americanexpress.com/account/login

- Login with the online account for card activation.

- Then you can use the card.

Pre-Qualify for American Express Card:

- Visit the American Express Card portal. The web address for the portal is www.americanexpress.com/account/login

- At top left side of the page click on ‘cards’ tab.

- From the drop down click on ‘View all credit cards’ button. Find the ‘Blue Cash Everyday’.

- Click on ‘View details’ tab.

- At the center right side click on ‘Check for better offers’

- Add your first and last name, home street address, suite or apt, zip code, city, state, last 4 digits of your social security number, total annual income, nontaxable annual income.

- Click on ‘View my card offers’ button at the bottom left side.

Apply for American Express Card:

- Go to the American Express Card official portal www.americanexpress.com/account/login

- From the card section click on ‘Apply now’ button under the Blue Cash Everyday card at the center left side of the page.

- Provide your full name, first name, last name, email address, date of birth , mobile phone number, home address, home street address , apt, zip code, city, state, social security number, total annual income, nontaxable annual income, income source

- Now click on ‘Continue to terms’ button at the bottom left side.

Also Read: Access your Fedility 401k Investment Online Account

American Express Bill Pay by Mail:

- You can pay the bill by mail and send a check or money order.

- Post it to, Overnight: P.O. Box 650448 / Dallas, TX 75265-0448.

- Express Mail: 20500 Belshaw Ave. / Carson, CA 90746.

American Express Pay by Phone:

- Pat the bill through your debit or credit card

- The number is: 800-472-9297.

Frequently Asked Questions on American Express:

- How Much Is 60000 American Express Points Worth?

American Express Membership Rewards focuses merit a normal of 1.8 pennies each. That considers the wide assortment of recovery choices accessible to you, whether moving them straightforwardly to aircraft and inn accomplices or involving them as a credit while booking through the Membership Rewards Travel entryway.

- How Do You Get American Express Platinum Points?

Earn 5 AMEX Membership Rewards focuses per spent on airfare 5 AMEX Membership Rewards focuses per spent on prepaid inns set up for AMEX Travel. 1 AMEX Membership Rewards point per on all the other things.

- How Do You Get A Black American Express Card?

Fitting the bill for the American Express Centurion Black Card While there are no distributed necessities, the overall agreement is that you should meet the accompanying models: Own an American Express MasterCard for no less than one year. Spend something like 0,000 to 0,000 every year. Procure somewhere around million every year.

American Express Contact Information:

For further assistance call on the toll-free number 1-800-528-4800.

Reference Link:

www.americanexpress.com/account/login