How to Track Your IRS Stimulus Check (COVID-19)

A grim economic picture is emerging throughout the world because of ongoing Covid-19. In this situation, the US Federal Government has promised to send $1,200 check or digital deposits to the residents of America. Qualified applicants will receive $1,200. More than 90 million people have already received their payments up to $1,200 via direct deposit. IRS also mailed the first wave paper check. But send all the check-in mail, it will take around 20 weeks.

The US House of Representative Committee estimated that the IRS will require around 20 weeks to send all the checks via mail. But don’t worry about it. By setting up an electronic funds transfer, you can still get your funds as soon as possible. You can simply follow the steps mentioned below to track your status.

What Eligibility is Required for IRS Get My Payment

Almost every American is eligible for the $1,200 stimulus check. For the stimulus check, the income is the main eligibility requirements.

- If any individuals are earning annually up to $75,000 or couples earning annually a 150,000, then they will receive the full amount of $1,200 per adult. If they have any child, then they will receive an extra amount of $500 per child.

- If your income is between $75,000 and $99,000 per year or any married couple earning between $150,000 and $198,000 per year, then the amount of payment may reduce.

- If anyone’s earning is exceeding these income limits will not get any check.

- The stimulus payment will be based on your last submitted tax return. If you submitted the 2019 tax form, then they will use the income from 2019. If you not yet filed your tax, then you can use the 2018 tax return information.

- Those who don’t file an income tax can submit their payment info manually.

How Will I Receive My Stimulus Check?

The taxpayer with the direct deposit information on the IRS file will receive the check as a digital direct deposit. They have already started the digital payments. You will receive your payment soon.

If you don’t have the direct deposit details on the file, then you can manually submit your details. Otherwise, wait for the physical check to be mailed.

The IRS will check the last tax return information on file, include reported income, bank account, and address. If your address has changed, then you have to update it soon.

How to Track IRS Stimulus Check Status:

You can track your Stimulus check through the IRS’s My Payment web portal. But before that, you have to be eligible for the payment. Because of high demand, you may have to wait a few minutes to access the site. You have to track your Stimulus Check status just by following these steps below:

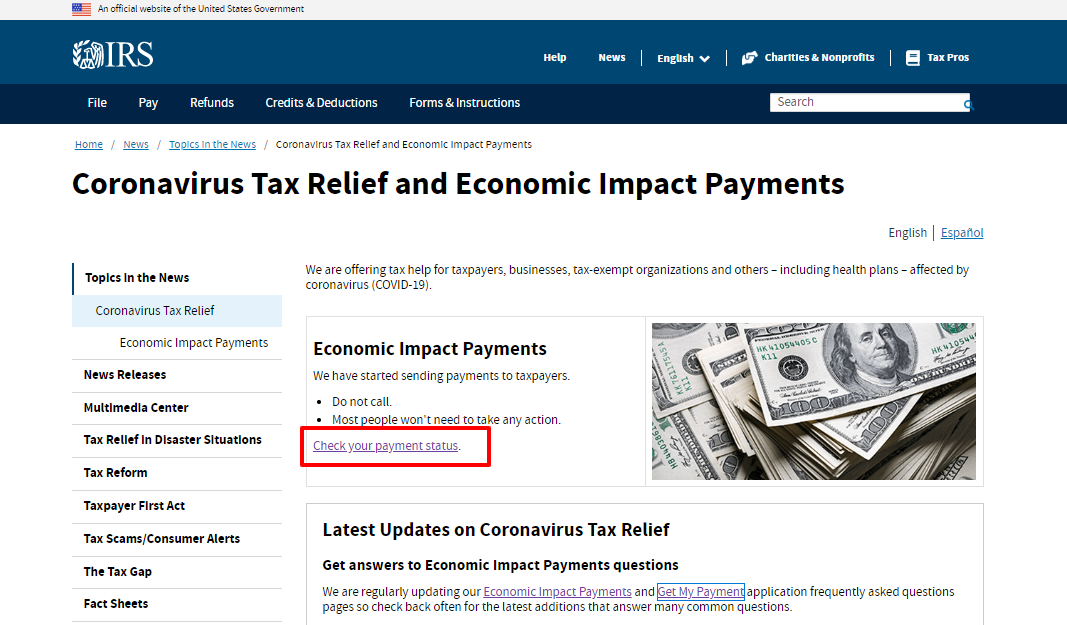

- First, you have to visit this link irs.gov/coronavirus

- Then, click on the Check Your Payment Status option.

- Then, simply click on the Get My Payment option.

- Again, you have to click on the Get My Payment option.

- Click on the OK option for further steps.

- Then, enter your social security number or individual Tax ID number.

- Then, enter your date of birth.

- Enter your street address.

- Then, enter your zip or postal code on the last filed.

- After that, you have to click on the Continue button for the further process.

When You Will Receive the Stimulus Check?

IRS has started the stimulus check payment around 15th April this week. About 90 million payment has been already done as of today. The IRS is going to make payments of around 150 million. It means more than half of the stimulus payments have been already done. If you do not receive your stimulus check yet, then you can track the status of the form at www.irs.gov/coronavirus.

Those who live in America and don’t have any direct deposit bank account details on the IRS file, then the payment can be delayed. If you are a taxpayer, then you can submit your bank account info at www.irs.gov/coronavirus. Otherwise, wait for the physical check to be mailed. It may take a week or month to arrive at the physical checks.

How the Non-Filers Will Submit Their Payment Info At IRS Get My Payment

If you do not file any income tax, then you have to submit your payment info manually. You can simply follow these instructions to submit your payment info:

- First, you have to visit this link irs.gov/coronavirus/get-my-payment.

- You just need to click on the Non-Filers: Enter Payment Info Here option.

- Then, you need to click on the Enter Your Information option.

- Then, you have to click on Get Started option.

- You have to create an account for further steps.

What to Do If Payment Status Not Available

There are several reasons for you may not able to check the payment status. Here are some of the following reasons:

- You are required to file a tax return. But:

- You may not yet finish your processing 2019 return.

- If the application doesn’t access your data, then you may not be able to check your payment status.

- If you don’t file a return:

- As a Non-Filer, you may have entered your payment info, but the IRS does not process your entry yet.

- If you receive SSI or VA benefits and that information is not updated on the IRS system, it could be another reason.

- You should check your eligibility first for the stimulus check. If you are not eligible, then you may not check the payment status.

Locked or Status Unavailable:

You have to verify your information first to access the Get My Payment option. If your provided information doesn’t match with the record, then your account will be locked for 24 hours. After 24 hours you can again access your account.

Read More: Application Process For Disability Benefits program Online

What to Do in Case You See Any Error Message

To provide the information correctly, you can use the helpful tips on the time of verifying identity. If your provided details don’t match the IRS records, then you probably receive the error message. So, you have to enter your information accurately.

If you get an error message, then you should check your recent tax return. If in your tax return, the street address has been entered different way, that could be another reason for the error message. Also, verify your address is formatted with the USPS. After that, you have to enter your address into the Get My Payment.

TouchPoint:

For any query, you can contact the customer service at:

Individuals: 800-829-1040

Available Hours: 7 a.m. to 7 P.m.

Businesses: 800-829-4933

Available Hours: 7 a.m. to 7 p.m.

Non-Profit Taxes: 877-829-5500

Closed Until Further Notice

Reference Link

www.irs.gov/coronavirus/get-my-payment

![[15:48, 27/04/2020] Anisur Da: ? [15:51, 27/04/2020] Anisur Da: www.irs.gov/coronavirus/get-my-payment](https://laddr.io/wp-content/uploads/2020/04/Internal-Revenue-Service.png)