Guidelines For The Login Of New York State Online Services Account

If you are looking for New York state official services then you must go through the registered portal and its procedures. The New York State website is the online opportunity and a platform provided by the state government to give the citizens many kinds of services online at their website. As a citizen, you can get business services from the website. It also offers you the culture and the recreation services as well as many others.

In this article, you will get to know more about the services of New York State online service processes. You also have to check the account creation with the login system, to get the full benefits.

Create an account with New York State online

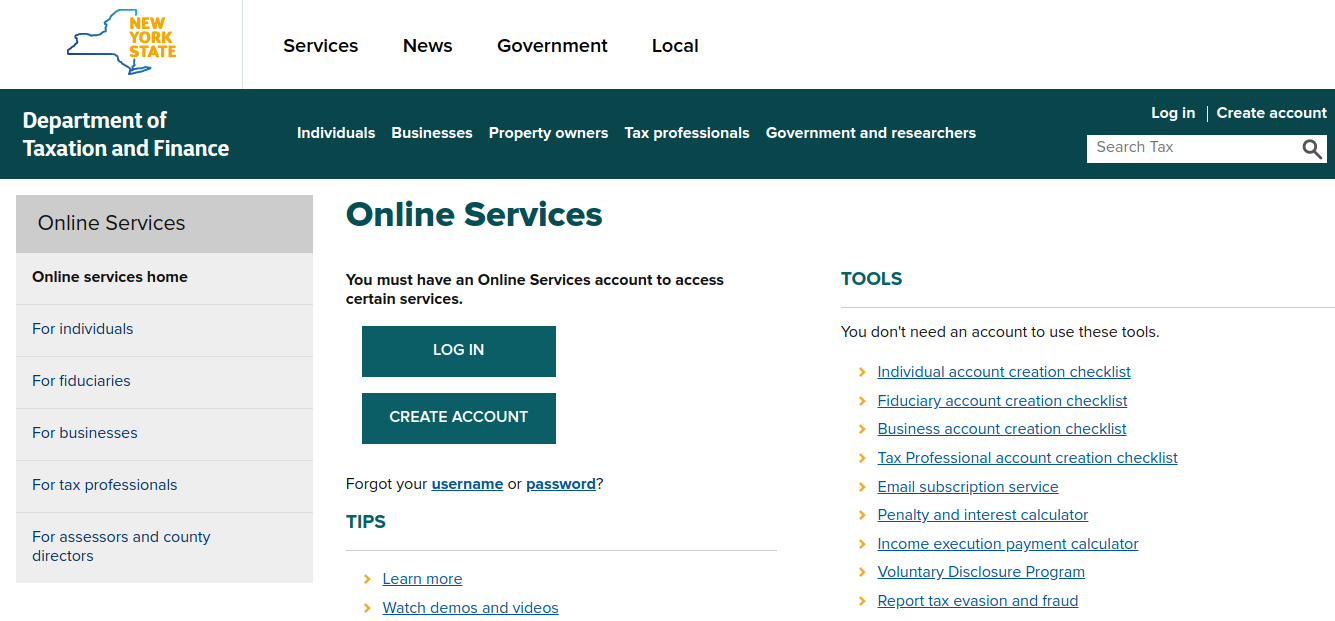

For this visit, www.tax.ny.gov/online

Here, at the middle left side, click on, ‘Create account’.

On the page, you will get three options in the middle of the page. You will get 4 options for the account creation and the information about it.

Business account

Create a Business Online Services account to file and pay New York State business taxes, including corporation tax, sales tax, and withholding tax. You can use a Business account to:

-

Get to view the filing and payment history for your business;

-

Web File and pay certain taxes;

-

You can pay bills and respond to notices;

-

Get to sign up for email notifications about bills, notices, and filing reminders; and

-

You can add employees as account users with different levels of access.

Individual account

Create an Individual Online Services account to manage your New York State personal income tax obligations. You can use an Individual account to:

-

Get to view your filing and payment history;

-

You can manage your estimated income tax payments;

-

You can pay bills and respond to notices;

-

Get to register or renew as a tax return preparer or refund facilitator; and

-

You can sign up for email notifications about refunds, bills, and notices.

Fiduciary account

Create a Fiduciary Online Services account to manage the New York State personal income tax obligations for an estate or trust. You can use a Fiduciary account to:

-

You will be able to view the filing and payment history for your estate or trust;

-

Get to manage estimated income tax payments for your estate or trust;

-

You can pay bills and respond to notices; and

-

Avail the sign up for email notifications about refunds, bills, and notices.

Tax Professional account

Create a Tax Professional Online Services account to act or obtain information on behalf of your clients. Your clients can authorize you to act on their behalf with E-ZRep Form TR-2000 or through their own Online Services account. You can use a Tax Professional account to:

-

You can view filing and payment history for your clients;

-

Get to pay bills and respond to notices for your clients;

-

Web File and pay certain taxes for your clients;

-

You can view correspondence your clients receive from the Tax Department; and

-

Get to add employees with different levels of access.

Your Online Services account is the fastest, safest way to interact with the Tax Department, and it helps protect you and your sensitive tax information from fraud. To be sure the person requesting an account is really you, we ask very specific questions that only you can answer.

Before you begin to create your account, review the checklist for the account type you’ve selected and gather the information you’ll need. You may need to refer to a tax return you’ve recently filed.

The guidelines for selecting your username and password and tips for recovering any of it.

Username

Your username must be between 8 and 60 characters long, and must consist of only:

-

Letters,

-

Numbers, Or

-

These Special Characters: . @ _ –

-

Password

Your password must be between 8 and 20 characters long. Passwords:

-

Are Case Sensitive,

-

Include At Least One Number And Three Letters,

-

May Not Use The Same Character More Than Two Times In a Row, And

-

May Contain Special Characters.

-

Account Recovery Tips

You have to make sure to keep your username in a safe place. We cannot reset usernames.

Remember which email address you used to set up your account. If you forget your username or password, you can use our self-help option to recover it using your email address.

Now, you have to click on the option, For business,

In the next page at the middle type,

-

The security code

-

Then, click on, ‘Continue’.

-

Specify the services you’d like access to

-

Then, click on, ‘Continue’.

-

If you go for all services, you will be asked if have the 5 digit PIN of New York state tax department.

-

If no, then, in the next page type the ,

-

Taxpayer ID number

-

Specify have you filed New York State corporation, sales, or withholding tax returns within the last 12 months?

-

Then, click on, ‘Continue’.

If yes, then type,

-

Taxpayer ID number

-

Five-digit PIN

-

Then, click on, ‘Continue’.

-

For individual account

-

Type the security code

-

Then, click on, ‘Continue’.

-

After that type, the SSN

-

And click on, ‘Continue’.

For Fiduciary, Type the security code

-

And click on, ‘Continue’.

-

In the next page, enter,

-

Estate or trust ID number

-

Estate or trust name

-

Fiduciary first name

-

Fiduciary middle initial

-

Fiduciary last name

-

Suffix

-

Tax year in which you filed a return

-

Total income ($)

-

Then, click on, ‘Continue’.

For tax professionals type,

-

Type the security code

-

Then, click on, ‘Continue’.

-

Specify if you have an Electronic filer identification number (EFIN)

-

If yes, click on ‘Continue’.

-

In the next page at the same place input,

-

Electronic filer identification number (EFIN)

-

Type of ID associated with the EFIN above

-

The legal name of a business

-

Your preparer tax identification number (PTIN)

-

Your New York Tax preparer registration ID number (NYTPRIN)

-

After this, click on ‘Continue’.

If no then follow the later prompts to create the account.

Logging into New York State online services

To log in, go to, www.tax.ny.gov/online

Here, at the middle left side, click on, ‘Log in’.

In the next page, at the middle, you will get a box, where input,

-

The username

-

The set password

-

Then, click on, ‘Sign in’.

You will be logged in.

Also Read : How To Login To Your Rite Aid Benefits Account

Forgot login details

If you have forgotten the login details, under the login box, click on, ‘Forgot your Username or Password’. For username, you will be taken to a new tab, and here enter,

-

First Name

-

Last Name

-

Email

-

Check the validation box

-

Then, click on, ‘Email me the username’.

For password type,

-

The username

-

Check the validation box

-

Then, click on, ‘Continue’.

You need to follow the prompts after this to get the details back.

Features of New York State online services

-

Get to view your account summary

-

Sign up for account-specific email alerts

-

Web File and pay certain taxes NY.gov ID Online Services menu option provides a list of online government services.

-

The online service determines which type of NY.gov ID account is required to access that online service.

-

Pay bills and notices

-

Respond to a notice

-

More information about Online Services

The services without New York State online services

-

Individual account creation checklist

-

Fiduciary account creation checklist

-

Business account creation checklist

-

Tax Professional account creation checklist

-

Email subscription service

-

Penalty and interest calculator

-

Income execution payment calculator

-

Voluntary Disclosure Program

-

Report tax evasion and fraud

-

File a tax preparer complaint

Additional information on New York State online services

-

Any personally identifying information provided to the NY.gov ID Service is collected, used and disclosed in accordance with the New York State Personal Privacy Protection Law or other applicable legislation. Further details can be found in the NY.gov ID Privacy Policy.

-

The NY.gov ID Online Services menu option provides a list of online government services.

-

The online service determines which type of NY.gov ID account is required to access that online service.

-

Your NY.gov ID account user ID and password must never be shared with anyone as provided in the Acceptable Use Policy for Users of NY.gov.

-

There is no charge for registering for an NY.gov ID account or using a Ny.gov ID account.

-

If a government online service describes or requires fees, the fees would be for the online service and not the NY.gov ID Service or your NY.gov ID account.

There are three types of NY.gov ID accounts:

-

Personal

-

Business

-

Government

Personal NY.gov ID: Allows persons acting in their individual capacity for their personal benefit to access Online Services and may require that individuals verify their identity (i.e. not for use by a business).

Business NY.gov ID: Allows business organizations registered in New York State to access Online Services, and may require that the business organization’s unique identity be verified and that the individual accessing the account be acting in a business capacity as an authorized representative of the business. Business NY.gov ID may be used by representatives of companies, partnerships, sole proprietorships or municipalities and not-for-profit societies. Additional accounts for employees acting in a representative capacity for a business can be created as required.

Government NY.gov ID: Allows State and local government employees to securely access Online Services Employee Functions.

-

Online government services provide a variety of functions and the nature of information shared between the online service and online service users varies from publicly accessible to highly confidential data. Privacy and security legislation and best practices require the NY.gov ID Service to protect the privacy and security of data when using online government services.

-

Privacy laws protect personal information (for individuals) differently than business information. For example, business contact information may be legally considered publicly accessible information, whereas personal contact information is usually not. The different types of NY.gov ID accounts balance the need to provide ease of service with privacy and security protection.

-

The nature of the online service determines which type of NY.gov ID is required by users of that service to access that online service.

-

A Personal NY.gov ID is used to access services that allow individuals to conduct personal business with the state, such as MyDMV or MyBenefits.

-

A Government Ny.gov ID is only available to employees of the NYS Workforce, including local government employees and consultants. The IDs are issued internally, require the employee id to be verified and allow the account holder to complete employee-related functions.

-

The NY.gov ID Service does not allow a Personal NY.gov ID to be converted to a Business NY.gov ID or Government NY.gov ID. The authentication methods and authoritative sources that are used to verify the unique identity of an individual are different and distinct from those used to verify the unique identity of a business or government user.

-

The NY.gov ID Service does not allow a Business NY.gov ID to be converted to a Personal NY.gov ID or Government NY. gov ID. The authentication methods and authoritative sources that are used to verify the unique identity of an individual are different and distinct from those used to verify the unique identity of a business or government user.

-

A Personal NY.gov ID account password expires after two years of inactivity on the account.

-

A Business NY.gov ID account password expires ninety days from the time it was last changed, or after one hundred eighty days of inactivity.

-

A Government NY.gov ID account password expires ninety days from the time it was last changed, or after one hundred eighty days of inactivity.

-

In the event you cannot remember your user ID or password, contact the Customer Care Center if you require additional assistance

Customer care

If you want to get in touch with the New York state department, you can call on, For individuals: 518-457-5181 (24/7)

For business: 518-457-5735, 8:30 a.m. to 4:30 p.m.

Reference :