About Citi Bank:

Citi Bank is the financial service provider of the United States. A few years later it became the First National Bank of New York. This bank server more than 2,700 within more than 19 countries. The US branches are basically located within metropolitan areas, like Los Angeles, Chicago, San Francisco, Miami, Washington D.C., and New York. Citi Bank offers mortgages, commercial loans, credit cards, etc.

Best Citi Credit Cards According to Out Choice:

If you are thinking of applying for the Citi Credit Card, then you might wonder which card you should apply for. Citi Bank offers several credit cards for their consumers. Here in this article, we will explain to you some of the best credit cards offered by Citi Bank.

Best for Cash Back Rewards: Citi Double Cash Card:

This a simple credit card and very easy to use. If you want to earn some cashback rewards, then you should definitely go for the Citi Double Cash Card. In this card, there will no purchase categories to track, no limits on your rewards earnings potentials. You have to pay any annual fees for this card.

Features:

- In this card, you can earn cash back twice. You will receive 1% cashback on purchases and as you pay for those purchases, you will receive another 1% cashback.

- There will be no annual fees for Citi Double Cash Card.

- For the first 18 months of your account opening, you will receive 0% intro APR.

Best for Bad Credit: Citi Secured Mastercard:

The best part of the Citi Secured Mastercard is, there will be no annual fees. This card requires a standard minimum deposit and will report the account information to the credit bureaus. So, it will help you to build a positive credit history. To apply for this card, you will require a bank account. Although, in this card, you can’t earn any rewards, but can surely improve your credit history.

Features:

- Citi Secured Mastercard will help you to build a credit history for your financial future.

- You don’t have to pay any annual fees for this card.

- It could be a perfect option for customers with little or no credit history. When you use this card, it will help you to build your credit.

Best for Travel: Citi Premier:

If you are a frequent traveler and want to earn some rewards, then Citi Premier Card will be a perfect choice. On the top, this card comes with a very hefty signup bonus of 60,000 ThankYou points by spending $4,000 on this card. Other than this, you can earn several points with this card.

Features:

- Within the first 3 months of spending $4,000 in this card, you can earn 60,000 ThankYou points. Later, you can redeem your ThankYou points for $600 in gift cards at thankyou.com.

- From 8/23/20, there will be an additional discount of $100 on a single hotel stay of $500 and more. You will get discounts on taxes and fees when you book through thankyou.com.

- You can transfer your points to certain loyalty programs, including Singapore Airlines KrisFlayer, Virgin Atlantic Flying Club, and TrueBlue.

Best for Balance Transfer: Citi Diamond Preferred Credit Card:

If you are looking for the best Citi credit card for the balance transfer, then this card would be an excellent choice. This is one of the best credit cards which comes with the longer intro balance transfer. If you have the high-interest debt on another card, then you will get rid of once and for all. One of the good features of this card is, you don’t have to pay any annual fees for this card.

Features:

- For the first 18 months of your account opening, your balance transfer APR will be 0%.

- For the first 18 months from the date of your account opening, your intro APR will be 0%.

- In this card, you will get free access to the FICO Score. You can monitor your credit score, whenever you want.

- With this card, you have dependable purchase protection, so you can shop with confidence.

How to Activate Citi Credit Card:

It is very easy to activate the Citi Credit Card. You just need to follow some basic instructions to complete the activation process. You may face a few difficulties for the first time. In that case, you can follow these instructions below:

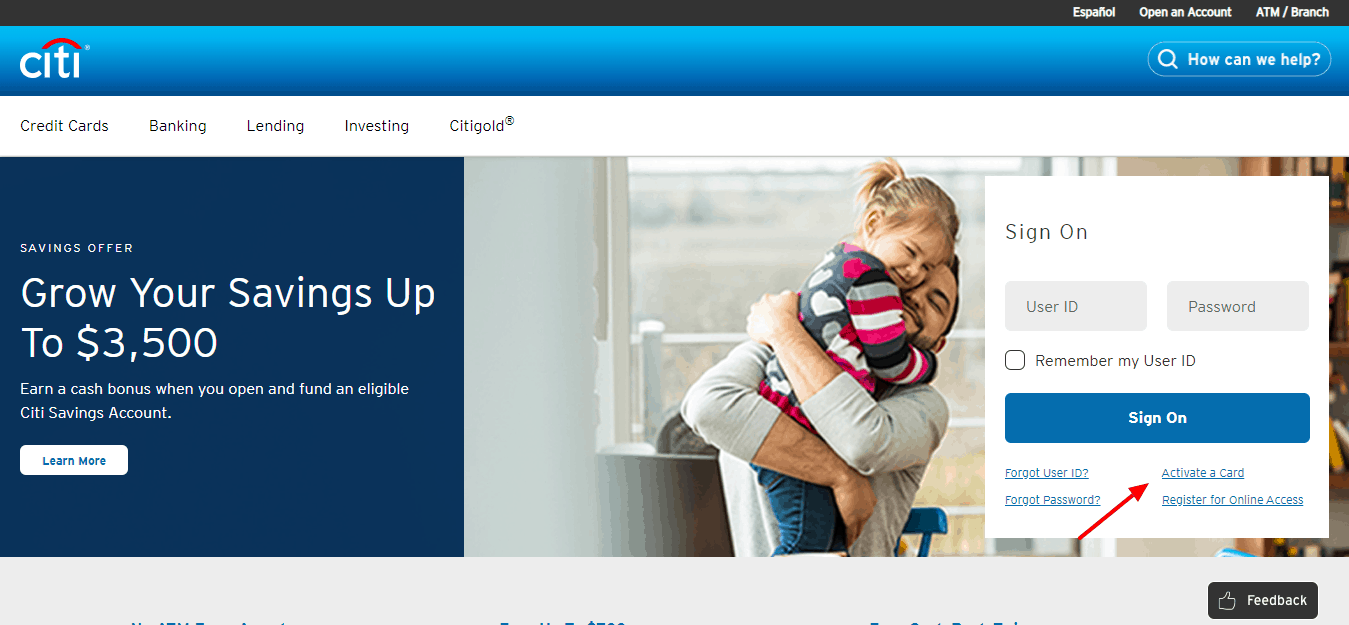

- First, you have to visit the official website of Citi Bank.

- Or, you can simply click on this link online.citi.com, for the direct access to the website.

- On the homepage, you will see the login section on the right side of the page.

- There, you need to click on the Activate a Card option.

- You have to provide your card number on the provided field.

- Then, you just need to click on the Continue button.

- Then, you have to follow the further steps to complete the activation process.

How to Register for Online Access:

In order to manage your Citi Credit Card or pay your bill, you have to register for online access. To register for the online access, you have to follow these instructions below:

- First, you have to visit the official website of Citi Bank.

- You can simply click on this link online.citi.com, for the direct access to the website.

- On the homepage, you will see the login section on the right side of the page.

- There, you need to click on the Register for Online Access option.

- You can register using your credit/debit card number or using the bank account number.

- After filling up the details, you need to click on the Continue Set-Up option.

How to Pay Citi Credit Card Bill:

There are several methods to pay your Citi Credit Card bill. To pay your Citi Credit Card bill, you just need to follow these instructions below:

Online Method:

You can pay your Citi Credit Card bill online. This is the best and easiest way to make the payment. To complete your payment, you need to follow these instructions below:

- First, you have to visit the official website of Citi Bank.

- By clicking on this link online.citi.com, you will be redirected to the website.

- There, on you get the login section on the right side of the homepage.

- There, you have to enter your registered user ID and password on the provided field.

- After that, simply click on the Sign On option.

- After entering the portal, you can make the payment very easily.

Also Read : Manage Your Kohl’s Charge Credit Card Account

Pay by Mail:

You can also complete your payment through the mail. You have to send your check or money order to this address below. Make sure to include your account number on the check or money order.

P.O. BOX 9001037

Louisville KY, 40290-1037

If you want to pay your Citi Credit Card bill through the express payment, then send your funds to this address below:

Citibank Express Payments

6716 Grade Lane

Building 9, Suite 910 Louisville, KY 40213

Citi Bank Customer Service:

If you have any query about the Citi Credit Card, then contact the Citi Bank at:

Phone: 1-800-950-5114

TTY: 1-800-325-2865

Mail:

Citibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117

Conclusion:

So, as of our choice, the above-mentioned credit cards are the best credit cards available in the market. If you are looking for the Citi Credit Card, then you can consider the above-mentioned credit cards.

Reference Link: