How to Check SBA Loan Status Online

Private company Administration 7(a) advances are perhaps the most ideal approaches to fund your endeavor. SBA credits, as the 7(a) advances are likewise known, are the office’s most well-known sort of financing. There’s one major drawback, nonetheless: It can be difficult to get credit from the SBA.

About SBA loan program

All things considered, low yearly rate rates make the SBA program probably the most astute approaches to subsidize your organization. With some expertise and readiness, you might have the option to make sure about probably the most reduced business financing accessible. What’s more, on the off chance that you don’t meet all requirements for an SBA credit, there are quicker, progressively available approaches to obtain cash, including on the web private company advances.

SBA credits are private company advances ensured by the SBA and gave by partaking moneylenders, generally banks. The SBA can ensure up to 85% of credits of $150,000 or less and 75% of advances of more than $150,000. The normal 7(a) credit sum was about $425,500 in 2018, as indicated by the office’s loaning insights. The program’s most extreme advance sum is $5 million. In case you’re hoping to open another area, recruit representatives or renegotiate a current credit, SBA advances are an incredible choice. SBA advance rates and terms ordinarily are more sensible for borrowers than different sorts of financing.

The types of SBA loan

7(a) advance program

-

Governmentally ensured term advances of up to $5 million.

-

Assets for working capital, extension, hardware buys.

-

Prepared through credit associations, banks, particular moneylenders.

504 advance program

-

Governmentally ensured advances of up to $5 million.

-

Assets for purchasing land, apparatus, offices.

-

Handled through private-segment banks and not-for-profits.

Microloans

-

Advances of up to $50,000.

-

Assets for working capital, stock, hardware, beginning a business.

-

Prepared through network-based charities.

SBA debacle advances

-

Credits of up to $2 million.

-

Assets for entrepreneurs influenced by cataclysmic events and different crises.

-

Prepared through the SBA.

The rates of SBA loan

-

$25,000 or less: 7.50% (Paid off in 7 years) and 8.0% (Paid off more than 7 years)

-

$25,001 to $50,000: 6.50% (Paid off in 7 years) and 7.0% (Paid off more than 7 years)

-

Over $50,000: 5.50% (Paid off in 7 years) and6.0% (Paid off more than 7 years)

SBA credit ensure

Moneylenders give the assets that make up an SBA advance, however, the office ensures a part of the sum, up to a $3.75 million assurance. That implies on the off chance that you default on the credit, the SBA pays out the insured sum. This assurance lets loan specialists offer longer terms for reimbursement than they, in any case, could, which implies your regularly scheduled installments will be lower.

Also Read : How to Join SafeLink 2g Migration Services

How to check loan status online of SBA

To check it open the homepage, www.sbaloanstatus.com

Once the page opens, you will get the see the application rules.

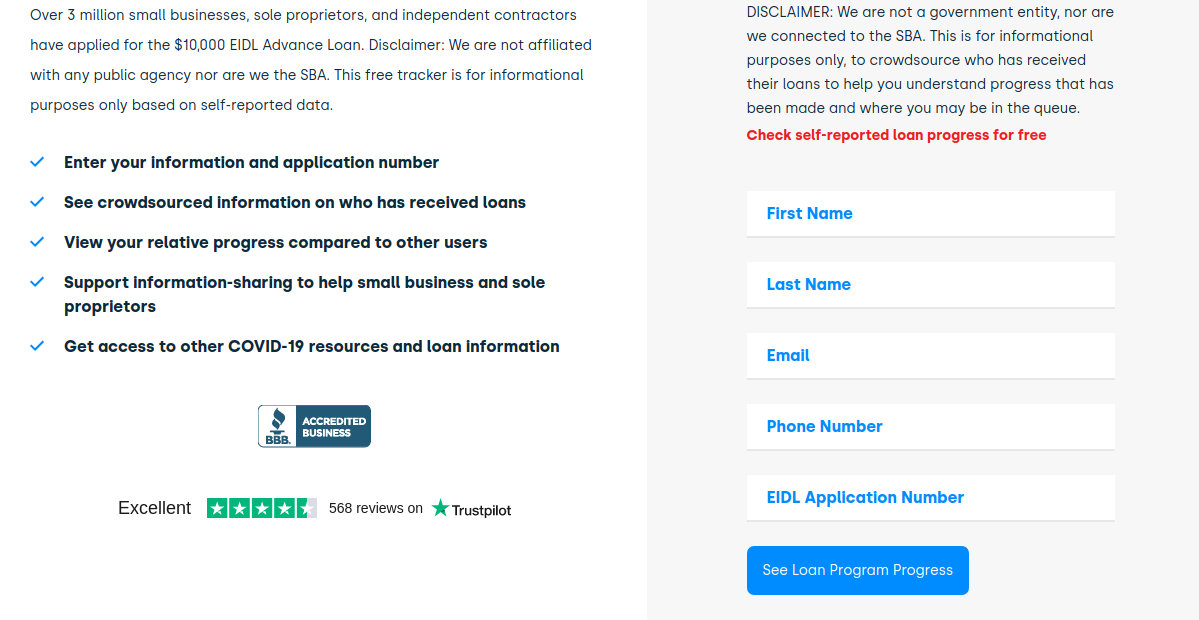

-

Enter your data and application number

-

See publicly supported data on who has gotten advances

-

View your relative advancement contrasted with different clients

-

Bolster data sharing to support independent company and sole owners

-

Gain admittance to other COVID-19 assets and advance data

At the right section provide the required information:

-

First Name

-

Last Name

-

Email

-

Phone Number

-

EIDL Application Number

-

Now tap on, ‘See Loan Program Progress’ button to proceed further.

Customer care

To get customer support call on, 800-827-5722. Or write a letter to, 409 3rd St, SW. Washington DC 20416. Also, check these pages,

Reference :

www.facebook.com/business/boost/grants

www.instagram.com/sbaloangroup

www.linkedin.com/company/sba-loans