Request for a Chase Credit Line Increase :

By increasing your credit limit, you can get some extra flexibility, if money is tight. If you are using a Chase credit card, then you can ask Chase to increase your credit limit. It will help you to build your credit and gives you additional spending power. Unlike the other credit card issuers, you can not request a credit increase online. To request a credit increase, you have to call the number on the back of your rewards credit card. Before calling Chase, here are some tips on your credit line increase request.

Before Request for a Credit Increase :

Before you request a credit increase, the question arises that whether it is a good idea or not.

What is Your Current Credit Limit?

Firstly, you should check that how much credit is Chase currently giving you. You can check your credit limit by login into your Chase account. You can check your credit limit alongside the rest of your credit card information. If you are using the Chase Mobile App, then you have to select the Show Details option. For any reason, if you cannot find your credit limit, then you can calculate it by adding your current balance to your available credit.

How Much Credit Do You Need?

After you find out your credit limit, you should consider how much credit you want. In general, it is a good idea to increase your credit limit, but you should not request a widely large credit limit increase. For example, you can go for the $5,000 to $6,000, rather than going for the $5,000 to $15,000. You must have a reasonable number in mind and also make sure to back up your request with the proof.

Are You Eligible for an Increase?

There are mainly two factors that will determine your eligibility, your account history, and your credit score. If you are using a Chase credit card for few months, then you might not be eligible for the credit limit increase. Chase determined your credit limit at the time of applying for the credit card, and you have to wait at least six months before requesting an increase.

We recommend you check your credit score before requesting the credit limit increase. If you have a good or excellent credit score, then your request might be successful. If your credit score is below the average, then you should take steps to build your credit score. One thing you should keep in mind is that a credit limit request may come with a hard pull of your credit score. It might drop your credit score by up to 10 points.

Request for a Chase Credit Limit Increase :

There are mainly four ways to request for credit limit increase. These are the four ways to increase your Chase credit limit and increase your purchasing power:

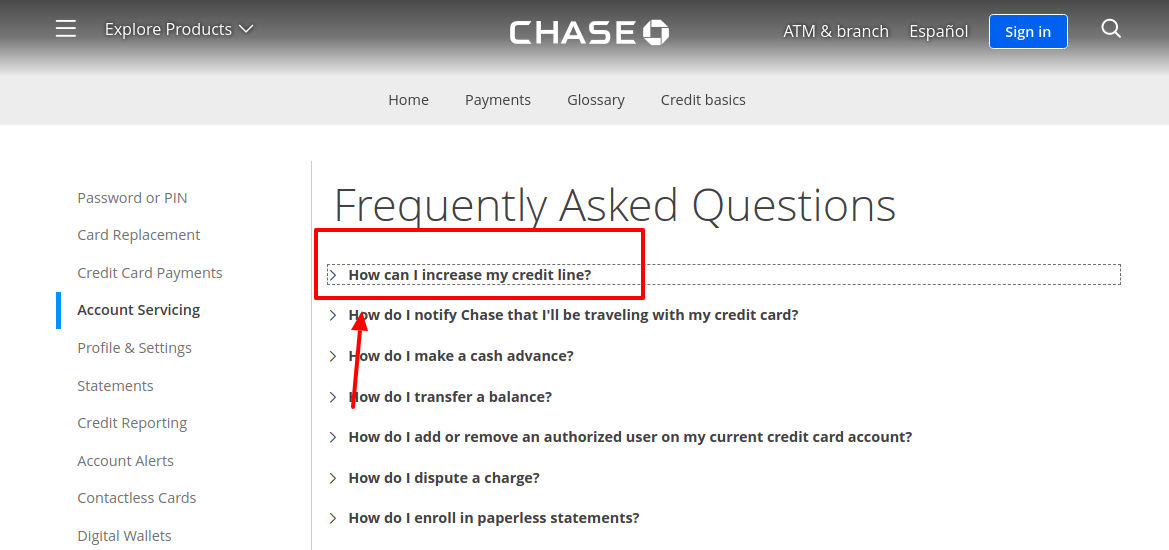

go to www.chase.com/personal/credit-cards/card-resource-center/acct-servicing page

- Click on How can I increase my credit line?

- And follow the steps.

Apply for a New Chase Card:

You can apply for a new credit card to increase your credit line. Although a new credit card would not increase the credit limit of your old Chase card. But it gives an additional credit line to use. Using that extra available credit could even increase your credit score.

There are some other advantages of having multiple credit cards. You give the ability to earn sign-up bonuses and cashback and earn points from the rewards credit cards.

In some cases, you might eligible for a new pre-approved credit card without harming your credit score. But, make sure to remember Chase’s 5/24 rule. If you already own 5 credit cards within the last 24 months – be it from Chase or another issuer – Chase will turn down your application.

Request a Credit Limit Increase:

To request a credit limit increase, you have to call the number on the back of your credit card. Currently, you can only request a credit limit increase over the phone. There is no online method available to request for a credit limit increase. Be prepared to discuss the credit limit you like to increase, as well as your employment status, current income, and reason for requesting more credit.

Receive an Automatic Credit Limit Increase:

Some Chase credit cardholders with good credit scores receive an automatic credit limit increase. To increase your credit limit with Chase, you should manage your current credit account responsibly, avoid carrying high balances and make on-time payments.

Update your income with Chase and it will boost your odds of earning an automatic credit limit increase. If you recently got a new job, got a promotion or other increased your income, let Chase know.

Also Read : Manage your First Republic Bank Online

Respond to a Targeted Credit Limit Increase:

Many times, Chase automatically increase your credit line, and sometimes, they ask you if you want to increase your credit line or not. You can respond to these credit limit increases and it will also help you to build your credit. You can check these kinds of the offer by login into your Chase account, though you may also get an email with a new or outstanding offer. Just accept the offer and the credit limit will automatically be applied to your account.

How Much Time Does It take to Increase Your Credit Line?

In many cases, within a minute you can learn the results of credit line increase requests. Once you approved a credit line increase request, it will immediately be applied to your account.

How Much Credit Limit Should You Be Using?

You should not use more than 30% of your available credit, with the ideal utilization ratio of under 10%. As for example, if your credit limit is $1,000, your balance should not exceed $300. If you are using more than 30% of your credit, it could harm your credit score.

Make sure to remember that this guideline primarily applies to revolving balances that stay on your card from month to month. If you have a $1,000 credit limit and using the $500 to your card, utilizing your credit will not affect you as long as you pay the balance on time.

What to Do If Your Request Denied :

There are still have options if your credit line increase is denied. These are the ways to manage your credit after getting denied for a credit limit increase:

- Try a Balance Transfer

- Improve Your Credit Score

- Apply for a Different Credit Card

Contact Chase :

For any issue regarding the Chase Credit Card, you can contact the customer service department.

www.chase.com/digital/customer-service

Reference :

www.chase.com/personal/credit-cards/card-resource-center/acct-servicing