H&R Block Coronavirus Stimulus Check

A statement has been issued by the H&R Block for its customers regarding their stimulus checks. If the customer of H&R has received their 2019 tax return on an emerald card, then they will also receive their payments. But if you haven’t’ filed your tax return yet, then you have updated your information manually. So that the IRS has your most current information. You should check your H&R Block Coronavirus Stimulus online for the latest updates.

Eligibility for the H&R Block Coronavirus Stimulus Check

More than 90% of American adults are eligible for the stimulus payment. Whether you full-time employee or part-time, a gig worker, unemployed, you are eligible for the stimulus check or direct deposit. Most of the taxpayer is eligible for the stimulus check. You will require an SSN or adoption tax identification number. But there are few taxpayers, who are not eligible for the stimulus check. These following taxpayers will not receive the stimulus payment:

- Anyone dependent.

- Non-US resident.

- Trusts and estates will not receive the stimulus check payment.

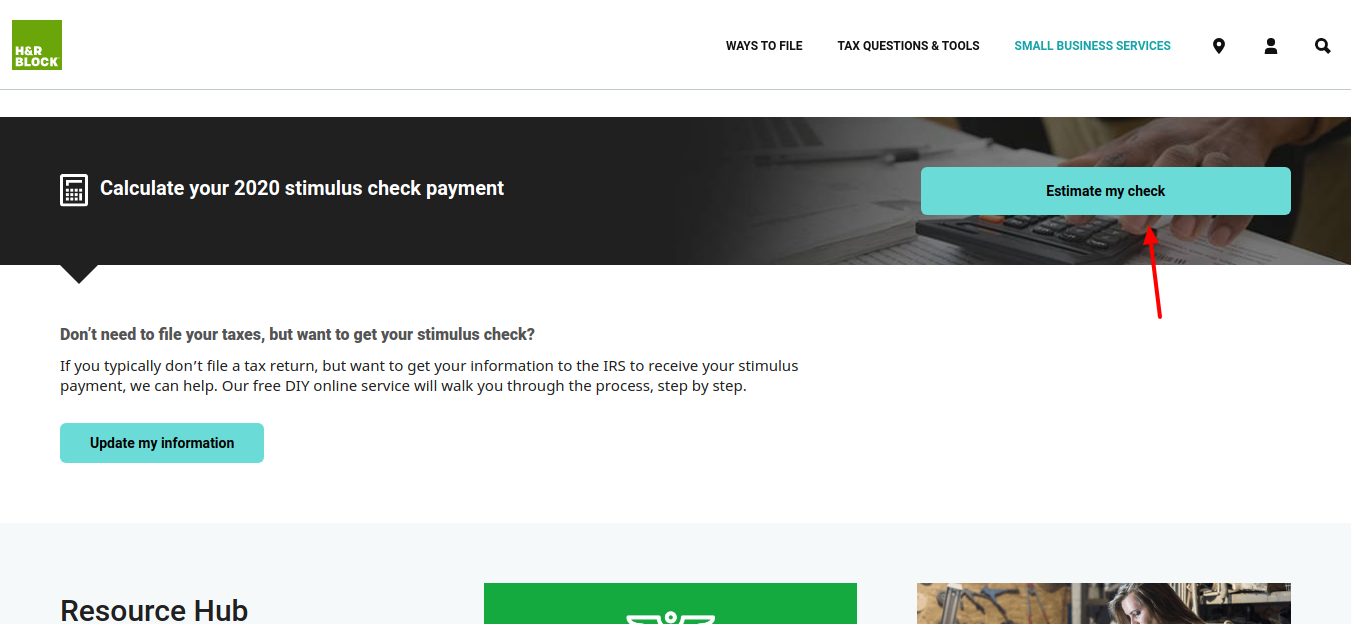

How to Calculate Stimulus Check Payment

It is very easy to calculate the stimulus check payment. You have to follow some basic instructions below to calcite the Stimulus Check payment:

- First, you have to visit this link www.hrblock.com/coronavirus.

- Then scroll down the page and click on the Estimate My Check.

- Then select Yes if you filed your 2019 taxes. If you have not filed your taxes, then select No option.

- After that, you need to select the filing status for 2019.

- Now, provide your gross income as of 2019.

- Then, you have to select the number of children under 17 years that you have claimed as dependents in 2019.

- After that, you have to click on the Calculate option.

Get Stimulus Check without Taxes

If you don’t file a tax return in 2018 or 2019, but want to get the IRS info to receive the Stimulus payment, then you can follow this process, step by step:

- First, you have to visit this link www.hrblock.com/coronavirus

- Then, scroll down the page and click on the Update My Information option.

- Then, click on the Start Filling Today.

- Enter your email address on the provided field.

- Then, click on the Next button for further steps.

- Create a username for the account.

- Then, you have to create a password for the account.

- Retype your password for confirmation.

- After that, simply click on the Next button for further steps.

Also Read : Login To Your NJ Unemployment Account

How to Do You Get Paid

People who have filed their 2018 or 2019 tax return, will receive their check on the state banking account reflected on the return field. If you don’t get the direct deposit, then you probably receive the check through the mail. IRS has launched a tool, called Get My Payment. There you will get the information regarding when and where your payment will be sent. You can follow these instructions below to find when your check will be sent:

- First, you have to visit this link www.irs.gov/coronavirus.

- Then, click on the Check Your Payment Status option.

- Then, you have to click on the Get My Payment option.

- Again, click on Get My Payment option.

- Then, click on the OK option.

- Then, provide your SSN or ITIN, date of birth, street address, and postal code.

- After that, simply click on the Continue button for further steps.

How Much Do You Get Paid

- The starting amount per person is up to $1,200. Using the stimulation check estimator, you can easily check the amount you are getting.

- If you filed the 2018 or 2019 tax return, then there is nothing you have to do. The IRS will mail payments and direct deposit to the account listed on your account, through which you last filed your tax return.

- Starting from April, the government plans to start the payment over the next few months.

Conclusion

If you filed your tax return in 2018 or 2019, then you will receive the stimulus check automatically. But if you haven’t yet filed your tax return, and want to get the stimulus check, then you have to provide your details manually. You may face a few difficulties for the first time. So, instructions as mentioned above.

Reference Link